A surety bond agent serves as a crucial intermediary in the world of finance and contractual agreements. With expertise in risk assessment and financial security, these professionals play a pivotal role in facilitating transactions and ensuring compliance with legal obligations.Evergreen Surety In this article, we delve into the intricacies of the surety bond agent's duties, their significance in various industries, and the qualifications required to excel in this field.

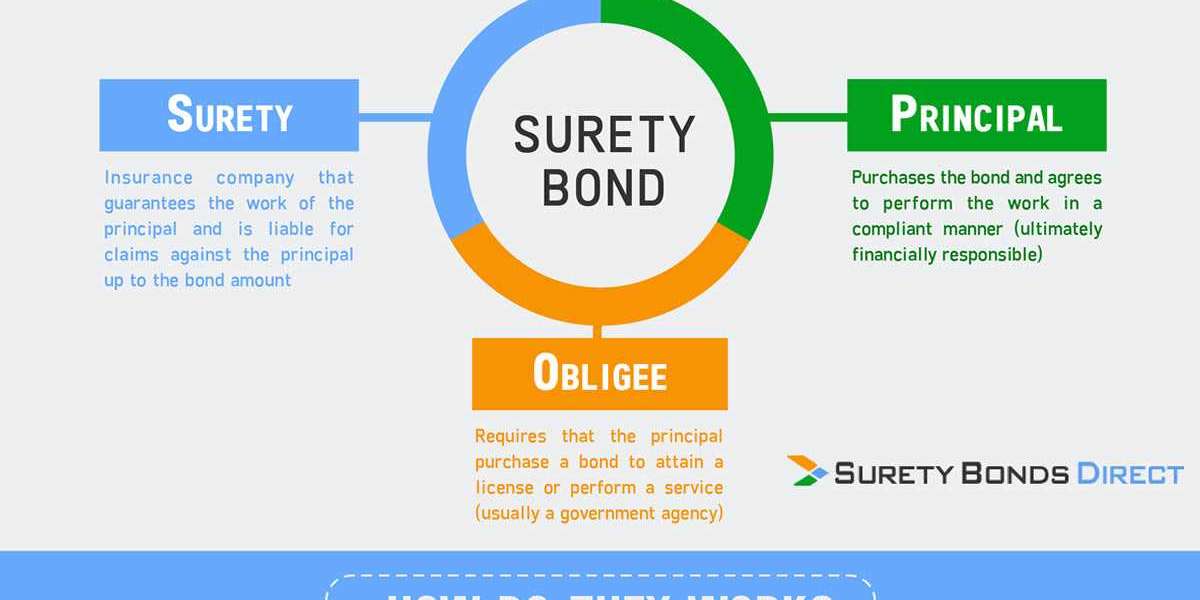

A surety bond agent acts as a liaison between parties involved in a contractual agreement, guaranteeing the fulfillment of obligations outlined in the bond. Whether it's construction projects, legal proceedings, or business ventures, their expertise mitigates financial risks and promotes trust among stakeholders.

Responsibilities of a Surety Bond Agent:

- Risk Assessment: Surety bond agents meticulously evaluate the financial stability and credibility of applicants to determine the feasibility of providing bonds.

- Facilitating Bonds: They assist clients in obtaining the necessary bonds tailored to their specific needs, ensuring compliance with legal and regulatory requirements.

- Monitoring Compliance: Throughout the bond period, agents monitor the bonded parties' performance, intervening when necessary to mitigate risks and uphold contractual obligations.

- Claims Management: In the event of default or breach of contract, surety bond agents manage claims, investigating the circumstances and facilitating resolution according to the terms of the bond.

- Client Advisory: Providing guidance and expertise, they advise clients on risk management strategies and the implications of contractual agreements, fostering informed decision-making.

Significance Across Industries: From construction and real estate to legal and financial sectors, the role of surety bond agents is indispensable. They safeguard investments, ensure project completion, and promote transparency in business dealings, contributing to economic stability and confidence in commercial transactions.

Qualifications and Expertise: Becoming a successful surety bond agent requires a combination of education, experience, and specialized knowledge in finance, law, and risk management. Most jurisdictions mandate licensing and adherence to stringent regulatory standards to uphold integrity and professionalism within the industry.

In a landscape fraught with financial uncertainties, the presence of surety bond agents instills trust and accountability, facilitating smooth transactions and protecting stakeholders' interests. Their expertise and diligence are instrumental in promoting economic stability and fostering a conducive environment for business growth and development.